NOTES TO TABLE

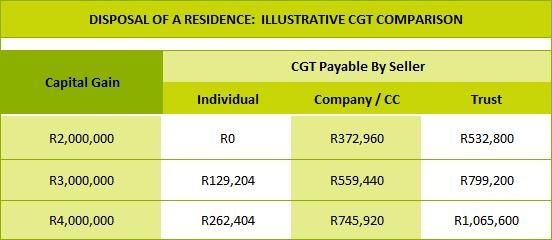

Dividend tax of 15% applies when companies and CCs distribute the proceeds. So if you want to take your profit out of the corporate, you will pay another 15% dividend tax over and above the CGT.

A “special trust” (i.e. a trust created solely for the benefit of a person who suffers from a mental illness or a person who suffers from any serious physical disability) is treated as an individual in this instance.

Holiday homes - although the “primary exclusion” of R2m applies only to a “primary residence” and not to a secondary residence such as a holiday home, the tax savings will still be significant.

On death, the “annual exclusion” increases to R300,000 for the year of death.

All exclusions are shown at the new, increased rates likely to come into effect shortly.

CGT for individuals is shown at the maximum marginal rate so it will be a lot less for anyone with a low marginal rate.

With a trust, you may be able to reduce the CGT substantially by having the proceeds taxed in the hands of a beneficiary with a low tax burden.

The window of opportunity is closing…..

You will lose out on these tax savings if you fail to act before the 31 December 2012 deadline.

Don’t delay – this is a complex issue with many grey areas, and you need to take proper advice NOW on these three questions –

Do you qualify for the relief?

If you do qualify, will it benefit you in your particular circumstances?

How should the disposal be structured to give you the maximum benefit?

FAQs

Do I qualify? Not everyone will qualify, but consult your attorney to check. If your property is mainly used for residential domestic purposes, you are off to a good start.

Does my holiday house or secondary residence qualify? Yes, the benefit has been extended to houses other than your primary residence, subject to restrictions relating to domestic, rather than business, usage. Remember that the “primary exclusion” of R2m won’t apply here.

What about my company/trust structure? If you have a “multi-tier” structure (e.g. your company owns the house, and another company or your trust owns the shares in the company) the benefit has also been extended to you. Again, this is subject to restrictions and requirements, so taking advice is essential.

Even if I qualify, will I benefit? Take full advice on this one – depending on your particular circumstances, there may be good reason to leave the property where it is. Consult a professional on considerations such as estate planning, asset protection, conduiting a trust’s distributions to a beneficiary with a low tax burden, etc.

Are there any risks? The disposal must be carefully structured by a professional to avoid any triggering of donations tax, dividends tax, adverse tax effects of any loan accounts etc. If the property is bonded, remember to give the bank timeous notice of cancellation, and also check that the transferee will qualify for a new bond (and if so, at what interest rate).

To whom should I transfer the property, how should I dispose of it, and at what price? Once again, take advice here - everyone’s circumstances will be different, and there are many considerations.

When must I dispose of it by? 31 December 2012.

What will it cost me? The good news is that there is no transfer duty payable, and CGT is “rolled over” i.e. not payable now. Provide for conveyancer’s fees, bond cancellation and registration fees, the cost to deregister or liquidate entities etc.

Once I have moved my residence into my name, how long do I have before de-registering or liquidating the entity that owned the residence? SARS gives you six months to begin these proceedings and will probably give an extension if you ask. If there are other assets in these entities, SARS have made concessions to help you – speak to a professional.

Take advice, and take it now!

This is serious stuff, with the potential for huge savings, but also the potential for significant losses if incorrectly handled. The complexities make it essential to get started now!

CHILD MAINTENANCE – WHO IS LIABLE (AND WHO ISN’T)?

When you need financial help to support your child, who can be forced to contribute?

A recent High Court judgment, which has received extensive media attention because of its negative impact on the right of grandparents to claim foster care grants, has shone a spotlight on the question of who has a legal “duty of support” towards children. In broad terms, the following are liable -

Biological parents (whether married or not),

Adoptive parents,

Then (failing parents able to provide support in part or in full) grandparents – both maternal and paternal, regardless of whether or not the parents were married,

Failing them, great-grandparents,

Failing them, siblings.

Note that step-parents have only a limited duty of support in “narrowly defined circumstances”, whilst other relatives (such as aunts and uncles) have no legal duty of support at all.

Granny and Grandpa – beware!

Your retirement funding is in for a serious knock if, say, your son divorces or fathers a child out of wedlock (or is alleged to have done so) and can’t make regular child maintenance payments. And if that happens to you, you are in for a long-term obligation at precisely the wrong time of your life!

TRUSTS – A HEALTH WARNING

Trusts can be extremely useful tools in estate and tax planning (and for protection of your assets from life’s misadventures), but they come with a health warning – assets held in a trust now belong to the trust, and no longer to you personally.

A perfect example of how things can go wrong in this regard is provided by a recent Supreme Court of Appeal case.

The medical damages claim

1. A company director had sold his shares and loan account in a company to his family trust.

2. About to undergo a back operation, he suffered a failed intubation by an anaesthetist, which left him in intensive care for a month, then bedridden, incapacitated and ultimately suicidal.

3. His consequent neglect of the company’s affairs, until his recovery some two years later, led to him suing the anaesthetist for damages, including R1.6m for “loss of income and earning capacity”.

The health warning

The anaesthetist accepted liability for whatever damages could be proved, and was duly ordered to pay damages for past and future medical expenses and for “general” damages (a technical term for non-monetary losses like pain and suffering, emotional hurt etc).

But the director failed in his loss of income claim, the Court holding that “the separateness of the trust estate must be recognised and emphasised, however inconvenient and adverse to [the director] it may be.” He could not benefit both from a (legitimate) reduction in estate duty and also “the continued retention of control and advantages of ownership of the trust assets”. Accordingly he had failed to prove any personal loss of income and earning capacity.

The message is clear – dispose of your assets to a trust only if you understand the full consequences as well as the benefits. Take advice in doubt!

DIRECTOR OR EMPLOYEE? APPLY THE “REALITY TEST”

Are directors employees? The question is an important one because our labour laws, particularly the Labour Relations Act, provide substantial protection only for “employees”. Now our courts have held that directors are to be regarded as employees “in appropriate circumstances”, and that the nature of an employment relationship should be determined primarily via three factors (any one of which could be decisive) -

1 The employer’s right of supervision and control;

2. Whether the employee forms an “integral part” of the employer’s organisation;

3. The extent to which the employee was economically dependent upon the employer.

The court will look at “substance rather than form”. In other words it will apply a “reality test” to determine what the true relationship is between the parties regardless of how the relationship may be labelled or described in agreements

A case in point

Thus in a matter recently before the Labour Court, a director holding 45% of the shares in a company was held, in all the circumstances of the matter, to be in reality also an “employee” and therefore entitled to the protection of the LRA against unfair dismissal.

Each case will be different, and there are plenty of grey areas here – proceed with caution!

THE OCTOBER WEBSITE: ALERT! MALWARE AND YOUR MOBILE

With a sharp increase in malware and virus attacks on smartphones and tablets (particularly Android devices) recently, it is vital that you secure your device with one of the many security apps available. Choose one that will also help you locate and recover the device in the event of loss or theft – some apps even enable you to remotely lock or wipe the device to protect your sensitive information from prying eyes.

First read the general security tips and free security app reviews in Computer World’s “5 free Android security apps: Keep your smartphone safe” at http://www.computerworld.com. Then, before you download your chosen app, check that it will actually work on your particular phone/tablet and operating system – if it doesn’t, Google for the best alternative.

Have a Great October!

Note: Copyright in this publication and its contents vests in LawDotNews(law.news)

Dividend tax of 15% applies when companies and CCs distribute the proceeds. So if you want to take your profit out of the corporate, you will pay another 15% dividend tax over and above the CGT.

A “special trust” (i.e. a trust created solely for the benefit of a person who suffers from a mental illness or a person who suffers from any serious physical disability) is treated as an individual in this instance.

Holiday homes - although the “primary exclusion” of R2m applies only to a “primary residence” and not to a secondary residence such as a holiday home, the tax savings will still be significant.

On death, the “annual exclusion” increases to R300,000 for the year of death.

All exclusions are shown at the new, increased rates likely to come into effect shortly.

CGT for individuals is shown at the maximum marginal rate so it will be a lot less for anyone with a low marginal rate.

With a trust, you may be able to reduce the CGT substantially by having the proceeds taxed in the hands of a beneficiary with a low tax burden.

The window of opportunity is closing…..

You will lose out on these tax savings if you fail to act before the 31 December 2012 deadline.

Don’t delay – this is a complex issue with many grey areas, and you need to take proper advice NOW on these three questions –

Do you qualify for the relief?

If you do qualify, will it benefit you in your particular circumstances?

How should the disposal be structured to give you the maximum benefit?

FAQs

Do I qualify? Not everyone will qualify, but consult your attorney to check. If your property is mainly used for residential domestic purposes, you are off to a good start.

Does my holiday house or secondary residence qualify? Yes, the benefit has been extended to houses other than your primary residence, subject to restrictions relating to domestic, rather than business, usage. Remember that the “primary exclusion” of R2m won’t apply here.

What about my company/trust structure? If you have a “multi-tier” structure (e.g. your company owns the house, and another company or your trust owns the shares in the company) the benefit has also been extended to you. Again, this is subject to restrictions and requirements, so taking advice is essential.

Even if I qualify, will I benefit? Take full advice on this one – depending on your particular circumstances, there may be good reason to leave the property where it is. Consult a professional on considerations such as estate planning, asset protection, conduiting a trust’s distributions to a beneficiary with a low tax burden, etc.

Are there any risks? The disposal must be carefully structured by a professional to avoid any triggering of donations tax, dividends tax, adverse tax effects of any loan accounts etc. If the property is bonded, remember to give the bank timeous notice of cancellation, and also check that the transferee will qualify for a new bond (and if so, at what interest rate).

To whom should I transfer the property, how should I dispose of it, and at what price? Once again, take advice here - everyone’s circumstances will be different, and there are many considerations.

When must I dispose of it by? 31 December 2012.

What will it cost me? The good news is that there is no transfer duty payable, and CGT is “rolled over” i.e. not payable now. Provide for conveyancer’s fees, bond cancellation and registration fees, the cost to deregister or liquidate entities etc.

Once I have moved my residence into my name, how long do I have before de-registering or liquidating the entity that owned the residence? SARS gives you six months to begin these proceedings and will probably give an extension if you ask. If there are other assets in these entities, SARS have made concessions to help you – speak to a professional.

Take advice, and take it now!

This is serious stuff, with the potential for huge savings, but also the potential for significant losses if incorrectly handled. The complexities make it essential to get started now!

CHILD MAINTENANCE – WHO IS LIABLE (AND WHO ISN’T)?

When you need financial help to support your child, who can be forced to contribute?

A recent High Court judgment, which has received extensive media attention because of its negative impact on the right of grandparents to claim foster care grants, has shone a spotlight on the question of who has a legal “duty of support” towards children. In broad terms, the following are liable -

Biological parents (whether married or not),

Adoptive parents,

Then (failing parents able to provide support in part or in full) grandparents – both maternal and paternal, regardless of whether or not the parents were married,

Failing them, great-grandparents,

Failing them, siblings.

Note that step-parents have only a limited duty of support in “narrowly defined circumstances”, whilst other relatives (such as aunts and uncles) have no legal duty of support at all.

Granny and Grandpa – beware!

Your retirement funding is in for a serious knock if, say, your son divorces or fathers a child out of wedlock (or is alleged to have done so) and can’t make regular child maintenance payments. And if that happens to you, you are in for a long-term obligation at precisely the wrong time of your life!

TRUSTS – A HEALTH WARNING

Trusts can be extremely useful tools in estate and tax planning (and for protection of your assets from life’s misadventures), but they come with a health warning – assets held in a trust now belong to the trust, and no longer to you personally.

A perfect example of how things can go wrong in this regard is provided by a recent Supreme Court of Appeal case.

The medical damages claim

1. A company director had sold his shares and loan account in a company to his family trust.

2. About to undergo a back operation, he suffered a failed intubation by an anaesthetist, which left him in intensive care for a month, then bedridden, incapacitated and ultimately suicidal.

3. His consequent neglect of the company’s affairs, until his recovery some two years later, led to him suing the anaesthetist for damages, including R1.6m for “loss of income and earning capacity”.

The health warning

The anaesthetist accepted liability for whatever damages could be proved, and was duly ordered to pay damages for past and future medical expenses and for “general” damages (a technical term for non-monetary losses like pain and suffering, emotional hurt etc).

But the director failed in his loss of income claim, the Court holding that “the separateness of the trust estate must be recognised and emphasised, however inconvenient and adverse to [the director] it may be.” He could not benefit both from a (legitimate) reduction in estate duty and also “the continued retention of control and advantages of ownership of the trust assets”. Accordingly he had failed to prove any personal loss of income and earning capacity.

The message is clear – dispose of your assets to a trust only if you understand the full consequences as well as the benefits. Take advice in doubt!

DIRECTOR OR EMPLOYEE? APPLY THE “REALITY TEST”

Are directors employees? The question is an important one because our labour laws, particularly the Labour Relations Act, provide substantial protection only for “employees”. Now our courts have held that directors are to be regarded as employees “in appropriate circumstances”, and that the nature of an employment relationship should be determined primarily via three factors (any one of which could be decisive) -

1 The employer’s right of supervision and control;

2. Whether the employee forms an “integral part” of the employer’s organisation;

3. The extent to which the employee was economically dependent upon the employer.

The court will look at “substance rather than form”. In other words it will apply a “reality test” to determine what the true relationship is between the parties regardless of how the relationship may be labelled or described in agreements

A case in point

Thus in a matter recently before the Labour Court, a director holding 45% of the shares in a company was held, in all the circumstances of the matter, to be in reality also an “employee” and therefore entitled to the protection of the LRA against unfair dismissal.

Each case will be different, and there are plenty of grey areas here – proceed with caution!

THE OCTOBER WEBSITE: ALERT! MALWARE AND YOUR MOBILE

With a sharp increase in malware and virus attacks on smartphones and tablets (particularly Android devices) recently, it is vital that you secure your device with one of the many security apps available. Choose one that will also help you locate and recover the device in the event of loss or theft – some apps even enable you to remotely lock or wipe the device to protect your sensitive information from prying eyes.

First read the general security tips and free security app reviews in Computer World’s “5 free Android security apps: Keep your smartphone safe” at http://www.computerworld.com. Then, before you download your chosen app, check that it will actually work on your particular phone/tablet and operating system – if it doesn’t, Google for the best alternative.

Have a Great October!

Note: Copyright in this publication and its contents vests in LawDotNews(law.news)

ACT NOW OR FOREVER LOSE THY PROPERTY TAX BREAK!

Your home, and the tax break

If you hold a residential property in the name of a company, CC or trust read on. You have a golden opportunity to save a huge amount of tax – provided you act now.

The background is that SARS wants to lower its administration workload by reducing the number of corporate entities and trusts so it can focus more on taxpayer compliance. As a result, SARS is incentivising you to transfer your residence to a (qualifying) individual now, by allowing you to do so free of transfer duty and dividends tax, and with the Capital Gains Tax (CGT) “rolled over” i.e. not payable until the new individual owner eventually sells the house down the line.

Why bother? Major tax savings

When you eventually sell the residence, you will pay CGT on any “Capital Gain”, and the benefit of this tax break lies in the fact that you are likely to pay a lot less CGT if the property is in an individual’s name than if you keep it in your corporate or trust. The CGT savings flow largely from the fact that only individuals stand to benefit from the “primary residence exclusion” of R2m and the “annual exclusion” of R30,000.

Another potential tax benefit is the saving of a further 15% in dividend tax (not shown in the figures below) which will be payable if your corporate sells the property and then distributes the proceeds.

Have a look at the following table to see just how much CGT you could save by taking advantage of this opportunity.

N.B. The figures shown below should not be taken at face value; they are only a rough guide to illustrate the potential tax savings. Take proper advice on your particular circumstances !

Your home, and the tax break

If you hold a residential property in the name of a company, CC or trust read on. You have a golden opportunity to save a huge amount of tax – provided you act now.

The background is that SARS wants to lower its administration workload by reducing the number of corporate entities and trusts so it can focus more on taxpayer compliance. As a result, SARS is incentivising you to transfer your residence to a (qualifying) individual now, by allowing you to do so free of transfer duty and dividends tax, and with the Capital Gains Tax (CGT) “rolled over” i.e. not payable until the new individual owner eventually sells the house down the line.

Why bother? Major tax savings

When you eventually sell the residence, you will pay CGT on any “Capital Gain”, and the benefit of this tax break lies in the fact that you are likely to pay a lot less CGT if the property is in an individual’s name than if you keep it in your corporate or trust. The CGT savings flow largely from the fact that only individuals stand to benefit from the “primary residence exclusion” of R2m and the “annual exclusion” of R30,000.

Another potential tax benefit is the saving of a further 15% in dividend tax (not shown in the figures below) which will be payable if your corporate sells the property and then distributes the proceeds.

Have a look at the following table to see just how much CGT you could save by taking advantage of this opportunity.

N.B. The figures shown below should not be taken at face value; they are only a rough guide to illustrate the potential tax savings. Take proper advice on your particular circumstances !